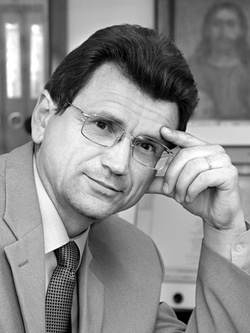

Ukraine should form national bank system on eternal, universal laws of human life. To help with it may moral laws of Islamic banking, after all "to live not according to desires, but according to possibilities is a moral law not only of the Islamic countries, but also the Bible principle inherent in our civilization". The president of the Association of Ukrainian Banks, Alexander Sugonyako, told about it in his interview to the "Day" newspaper.

Answering the question of a journalist about Islamic banking, the president of the AUB noticed that in Islam the system of relations between a client and a bank is built on the basis of general cultural wealth and moral standards. Hence, basic principles of interaction are defined not by human, but by Divine laws.

In their turn, Western financial systems went by the way of internationalization of key rules of bank operations and, thus, actually removed safety lock which protected them from too aggressive forms of development. "The system of the state regulation should become such a safety lock, but it, unfortunately, did not work", the expert stated.

He explained that unlike European, in Islamic banks there is no concept of interest for the credit. The borrower is obliged to pay to bank part of his incomes. Hence, both incomes, and losses a client and a bank should divide according to certain proportion. "Such an approach gave a chance to Islamic financial system to cut insolvent borrowers who cannot prove their ability to receive incomes and to limit rates of expansion of operations", Alexander Sugonyako emphasized.

The modern crisis phenomena in many respects proved such an approach. "Aggressive absorption of all segments of the market of crediting and coverage by credits of insolvent clients became the main reasons of financial crisis in the world", the president of the AUB noted.

At the same time the expert considers as one of positive treats of the international financial crisis that he demanded substantial increase of quality of management by banking, especially in risky management. "Banks should considerably improve analysis of validity of granting of credits and guarantees of their returning, having concentrated on crediting of real sector of economy and sharply having reduced loans for consumption. It is very important to make morals a basis of bank activity. Without it there will be neither trust to banks, nor stable and long-term development".

As he said, to live not according to desires, but according to possibilities is a moral law not only of the Islamic countries, but also the Bible principle inherent in our civilization. Laying on all hopes of the state as on universal regulator is the way to repetition of financial crises.

Standardization of relations between a bank and a client is the natural and useful process increasing labor productivity of bank system as a whole. "For this reason it is necessary for us to form national bank system on eternal, universal laws of human life", Alexander Sugonyako concluded.

It is necessary to notice that recently experience of Islamic banking which appeared to be much more stable before tests of the international financial crisis, are interested in Ukraine more and more.

In particular, in Ukraine will shortly open their branches Islamic banks which will work according to Shariat principles.

Besides, release of Islamic bonds is planned for the sum of 500-600 million Euro.

By "The Day"

Related Links:

News

Investments under Shariat Laws

In Ukraine to be Islamic banks

Ukrainian-Arabic Conference “Investment Opportunities in Ukraine” Took Place in Kyiv

In Ukraine Plan Issuing Islamic Bonds worth 500-600 Million Euros

Way out from Economic Crisis Lies in Islam, Considers Ukrainian Researcher

Articles

Shariat-Banking: Ukrainian banks try to Involve Muslim Investors

Prospects of Arabian Investments in Ukraine

Ukrainian Press Review

Utro.UA: Ukrainian Banks do not Hasten to give out "Muslim Credits"